Key CVS Metrics

Two key CRE themes emerged from CVS’ first-quarter update. First, while many expected visitations and sales growth to see some mean reversion in 2022 as the company lapped last year’s vaccination push, the decline has not been as severe as expected with visitation trends remaining ahead of pre-pandemic levels. Second, with CVS already 100 locations into its 900 planned store closure plan over the next three years, we can start to see the company’s future retail plans take shape.

- Increased visitation trends continue for CVS. While it's not surprising that visitation trends at CVS (and Walgreens) have moderated the past two months as we lap more difficult comparisons, visitation trends remain ahead of 2019 (below) and could indicate that consumer demand for alternative healthcare solutions and health and wellness products is likely to remain elevated in the future. In particular, CVS called out its strength in the front of the store this quarter, including over-the-counter COVID testing (not surprising) but as well as other categories (perhaps more of a surprise). Adding consistency to CVS’ foot traffic is its CarePass membership, which is up 33% year-over-year to 6 million members and should help to drive increased visit frequency in the future (while also serving as a customer acquisition tool for its more comprehensive healthcare-oriented retail formats going forward).

- Optimized retail store footprint taking shape. As we’ve discussed in previous reports, the company is optimizing its retail portfolio and will emphasize three distinct models going forward: (1) advanced primary care clinics, (2) enhanced HealthHUB locations and (3) traditional CVS Pharmacy locations. Thus far in 2022, the company has closed approximately 100 stores out of the 300 planned for this year (and the 900 planned by the end of 2024). What does Placer data indicate about these closures? We’ve identified roughly half of the 100 locations CVS has closed this year and grouped them as a custom chain to better develop insights about these locations and the chain’s future retail expansion strategies. The first (and perhaps least surprising) insight is that the stores closed during 2022 were generally laggards in 2021, underperforming chain averages by a significant margin (below).

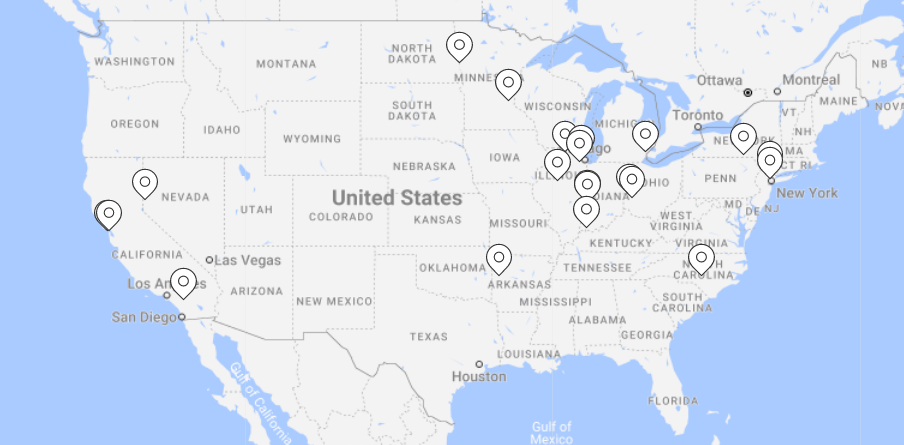

- The bulk of CVS closures appear to be in two types of markets: (1) urban markets with higher migration away trends the past few years, including Chicago and San Francisco; and (2) smaller markets (typically between 50K-150K in population) in Midwest states (including Illinois, Indiana, Ohio, Michigan, and Minnesota) that previously had multiple CVS locations (below). This isn’t terribly surprising, as CVS Chief Customer Officer Michelle Peluso had previously discussed the intention to "de-densify" is portfolio and that 85% of its consumers will still live within 10 miles of a CVS Health once the company has completed its store closures. Over time, we would not be surprised to see many of these markets add an enhanced HealthHUB or advanced primary care location offering comprehensive services.