Subway’s “optimization plan,” shared last year, has been driven primarily by remodels and relocations. Or as the chain said in a statement to QSR Monday, “having the best restaurants in the best locations to drive restaurant profitability”—a strategy, along with its franchise owners, the company said it’s focused on moving forward.

After reducing its U.S. count by 866 restaurants from 2016–2017, Subway has now dipped below 25,000 in the U.S., the company said. That’s roughly an 1,000-store drop from the 25,908 Subway closed 2017 with.

“As part of the optimization plan we shared last year, to achieve this goal some owners will close, relocate or remodel their locations and that will result in slightly fewer, but more profitable, restaurants,” a Subway spokesperson said in an emailed statement.

See the chart below to see the shift. Note: The 1,000 from 2,018 is not an exact figure.

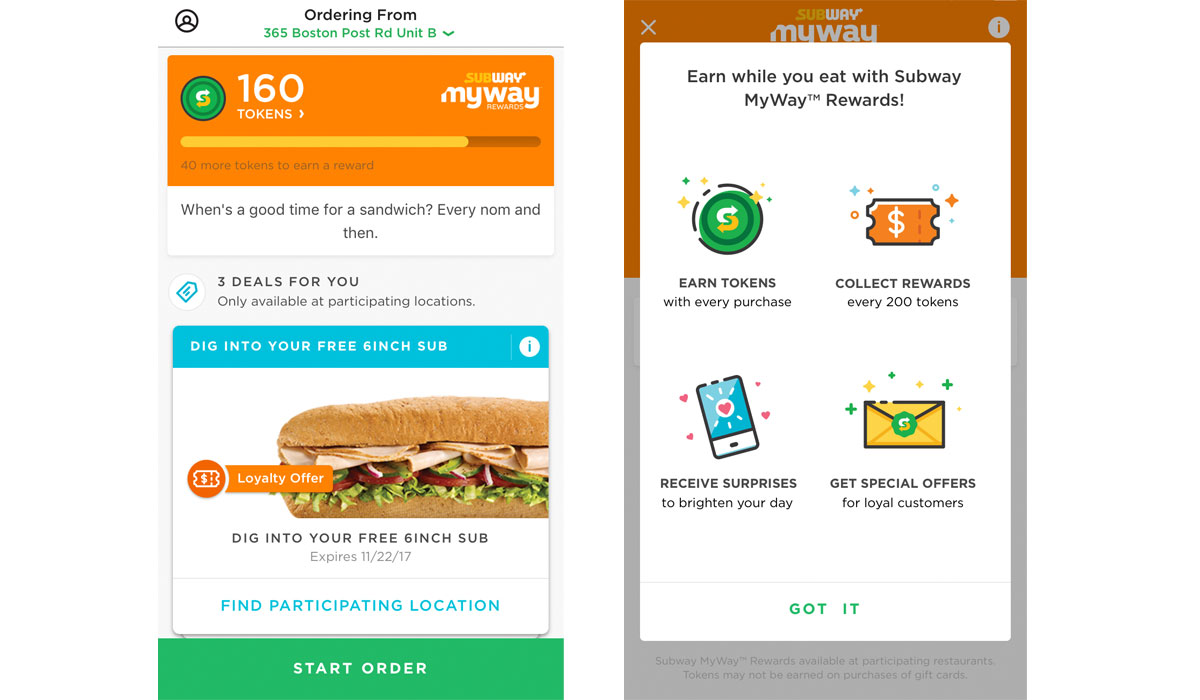

The company added that “franchise owners have remodeled hundreds of restaurants with the Subway Fresh Forward and Fresh Start designs and we’re now rolling out FreshNOW to all restaurants across the U.S. We also introduced the Subway MyWay Rewards program, remote ordering, third-party delivery and new menu items, all of which have had a positive impact on sales and traffic.”

Prior to the 866-store decline from 2016–2017, Subway added 4,456 locations the previous six years combined. At the end of 2017, Subway had US. Systemwide sales of $10.8 billion and average-unit volumes of $416,000. AUVs were $422,000 the year before and sales were $11.3 billion.

A recent New York Post report, which cited a “source close to Subway headquarters,” said the chain’s restaurants witnessed flat or slightly declining same-store sales in “most of the country” last year. The publication also previously reported, from a November 2017 internal memo it reviewed, that traffic dropped 25 percent from 2012–2017.

To Subway’s previous statement, significant changes rolled out over the past year. As of September, Subway said its “Fresh Forward” design was in 465 locations. Tracy Steinwand, the brand’s director of global operations, said it would be a “multi-year” process to update the system. And the development was also likely to ramp up in the backend of that timeline.

So far, though, Subway has been encouraged by early returns. In a comparison of Fresh Forward U.S. stores with old ones, Subway said there was a gross profit lift of 11 percent and traffic increases of more than 8 percent. It was even more pronounced in relocations, with sales and traffic boosting 18 and 15 percent, respectively.

The FreshNOW program arrived in August. It was piloted in San Diego, California, and reached about 500 U.S. locations come fall. Subway said earlier it expected the entire U.S. system to feature FreshNOW updates by May 2019.

Subway invested $80 million, Steinwand said, so it could make FreshNOW available to all of its stateside restaurants at no additional cost to operators. It’s funded by Subway, vendor partners, and existing marketing funds.

Unlike the Fresh Forward campaign, FreshNOW is heavy on culinary over décor. This includes, “Signature Flavor Stations,” which feature new sauces and flavorings, including a signature Sub Spice blend, Mustard Seed Spread, Herbs & Lemon Seasoning, Subway Signature Herb Garlic Oil, Provencal Herbs, and fresh cracked sea salt and black pepper.

Guests also see new “Fresh Pour Beverage Stations” offering elevated options such as Watermelon Agua Fresca, Passion Fruit Agua Fresca, Homestyle Lemonade, Green Tea, and Unsweetened Black Tea.

There are new employee uniforms and menu boards as well.

As for the digital callout, Subway chief digital officer Carissa Ganellia told QSR in November that the chain’s app, since a May redesign, witnessed year-over-year growth of 100 percent in users. Subway’s MyWay Rewards program, announced February 22, was built on the premise of a more customized experience wherein users can earn and redeem tokens in a variety of ways. The program is integrated into the new version of the app.

Subway launched delivery at 9,000 restaurants in October. The massive push involved partnering with UberEats, GrubHub, DoorDash, and Postmates.

The sandwich chain, which has more than 42,000 locations globally, has had some executive shakeups lately as well. James Walker, VP of North America, resigned January 18. Joe Tripoldi retired as Subway’s chief marketing officer last month. Roger Mader, the co-founder and managing partner of marketing agency Ampersand, is currently acting as interim CMO.

Subway is also still searching for a permanent chief executive following the May announcement that Suzanne Greco would step aside from day-to-day duties and officially retire in June. Trevor Haynes, the 44,000-unit chain’s chief business development officer who joined the company in 2016, has been serving as interim CEO. Greco took the reins as CEO in 2015 following the death of her brother and Subway founder, Fred DeLuca.